![MK socks Workers assemble new-energy vehicles in Chery's assembly workshop in Wuhu city,<strong><a href=]() MK socks East China's Anhui Province, on May 23, 2024. In recent years, Wuhu has prioritized this industry in its green transformation and industrial upgrading, drawing more than 300 companies across industries. Photo: VCG" src="https://www.globaltimes.cn/Portals/0/attachment/2024/2024-08-15/a746c477-01f7-4ac0-8fa2-e4bcf0cc7c97.jpeg" />

MK socks East China's Anhui Province, on May 23, 2024. In recent years, Wuhu has prioritized this industry in its green transformation and industrial upgrading, drawing more than 300 companies across industries. Photo: VCG" src="https://www.globaltimes.cn/Portals/0/attachment/2024/2024-08-15/a746c477-01f7-4ac0-8fa2-e4bcf0cc7c97.jpeg" />Workers assemble new-energy vehicles in Chery's assembly workshop in Wuhu city, East China's Anhui Province, on May 23, 2024. In recent years, Wuhu has prioritized this industry in its green transformation and industrial upgrading, drawing more than 300 companies across industries. Photo: VCG

China's economy continued to expand in July, with the output of industrial enterprises above the designated size up by 5.1 percent year-on-year, while retail sales rose by 2.7 percent, data from the National Bureau of Statistics (NBS) showed on Thursday.

The recovery's momentum is being fueled by a number of factors, analysts noted, including the "pull" effect of the government's more pro-growth policies, the traditional summer consumption peak, and the pick-up in high-tech manufacturing investment.

Observers said the latest key indexes showed that the world's second-largest economy stabilized and improved in July, after slowing slightly in June. The figures also showed a solid start to the second half of 2024, they said, and there are likely to be more stimulus moves to boost consumption and investment. All this will put the economy on a firmer footing to reach the annual GDP target of around 5 percent.

The 5.1 percent value-added industrial output growth in July compared with a 5.3 percent rise in June. The growth of retail sales in July was 0.7 percentage points faster than the 2 percent pace in June.

In the first seven months, fixed-asset investment rose 3.6 percent year-on-year, compared with 3.9 percent in the first six months, NBS data showed.

China's economy was generally stable and made steady progress in July, with high-quality development advancing solidly|, NBS spokesperson Liu Aihua said at a press briefing on Thursday. She also acknowledged a number of sources of downward pressure, ranging from the increasing adverse effect of the external environment, insufficient domestic effective demand, as well as a painful transition between old and new growth drivers.

Observers said that the July readings were largely stable and showed some "palpable" improvement from June - retail sales in particular. These readings signal better prospects for the economy in the second half of the year.

They pointed out that July is traditionally a peak travel season, which has led to a summer consumption boom.

"The number of domestic flights jumped in July compared with the previous month, while cultural and tourism-related consumption led to a rise in catering spending. The low base last year also provided support," said a research report by China International Capital Corp.

Cao Heping, an economist at Peking University, told the Global Times that fixed-asset investment maintained stable growth in July as economic activities revved up in the aftermath of natural disasters such as floods and heavy rains.

Investment in high-tech manufacturing continued to gain pace in the first seven months, with a rosy gain of 9.7 percent. This part of the economy will likely continue to display innate strength and resilience throughout the second half, despite sluggish investment in the real estate sector, which is undergoing a protracted correction.

Brisk exports in July bode well for driving up manufacturing sector investment, they added.

In July, further stimulus measures were carried out to inject new impetus into the economy. Meanwhile, the convening of a set of tone-setting government meetings sent clear signals for the launch of more effective, stronger measures to buttress the country's high-quality development.

Observers said that taking account of the GDP growth slowdown in the second quarter and the high base in the second half of last year, it should be acknowledged that the economy will face "considerable internal and external downward pressure" in the third quarter.

But they voiced confidence that GDP growth will reach the annual goal of around 5 percent.

Tian Yun, a veteran economist based in Beijing, told the Global Times on Thursday that China's stable growth of around 5 percent will be consequential for both the country and the world.

"In times of crisis, such robust expansion could make China a safe haven for global economy, especially when the US economy is at the risk of recession," Tian said.

China's GDP expanded 5 percent to 61.68 trillion yuan ($8.49 trillion) in the first half of 2024. In the second quarter, GDP grew by 4.7 percent year-on-year, edging down from 5.3 percent in the first quarter.

Cao said that he expected the GDP growth rate to be around 5 percent over the coming months. He noted that technological advancements and consumption upgrades are poised to drive economic growth, with government support for technology and innovative companies providing a new direction for growth.

As external uncertainties will persist in the second half of the year, the key to stabilizing growth this year lies in effectively shoring up domestic consumption and investment, analysts said. They predicted that government bond issues will peak in the third quarter, and infrastructure investment may therefore slightly rebound starting in August.

At the press briefing, Liu vowed that in the next stage, efforts must be made to strengthen macroeconomic adjustment, fully implement policies and measures, and consolidate the foundation for the continued economic recovery.

Zhao Chenxin, a deputy head of the National Development and Reform Commission, the top economic regulator, said in July that the country has "ample room for counter-cyclical policy adjustments" in the second half. He gave the example of the issuance of ultra-long special treasury bonds, local government special bonds and other initiatives to boost large-scale equipment upgrades and consumer goods trade-ins.

China's May Day holiday sparks surge in outbound travel

China's May Day holiday sparks surge in outbound travel Rift between two political families in Philippines intensifies as assassination remarks emerge

Rift between two political families in Philippines intensifies as assassination remarks emerge China’s first raptor conservation science book released at National Zoological Museum

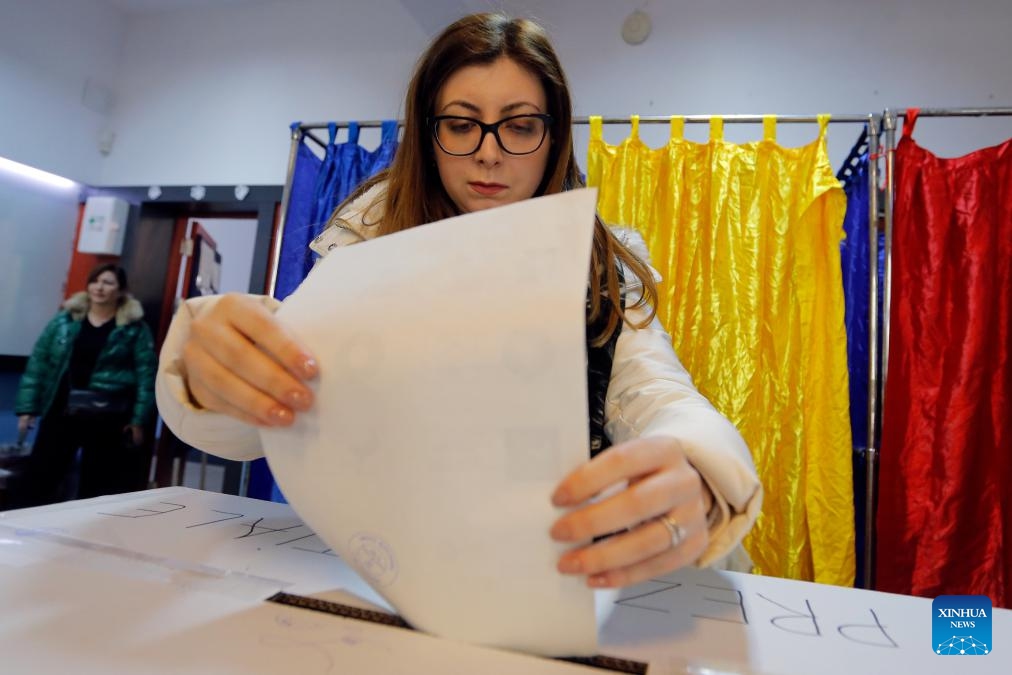

China’s first raptor conservation science book released at National Zoological Museum Calin Georgescu leads tight Romanian presidential race, runoff pricture unclear

Calin Georgescu leads tight Romanian presidential race, runoff pricture unclear