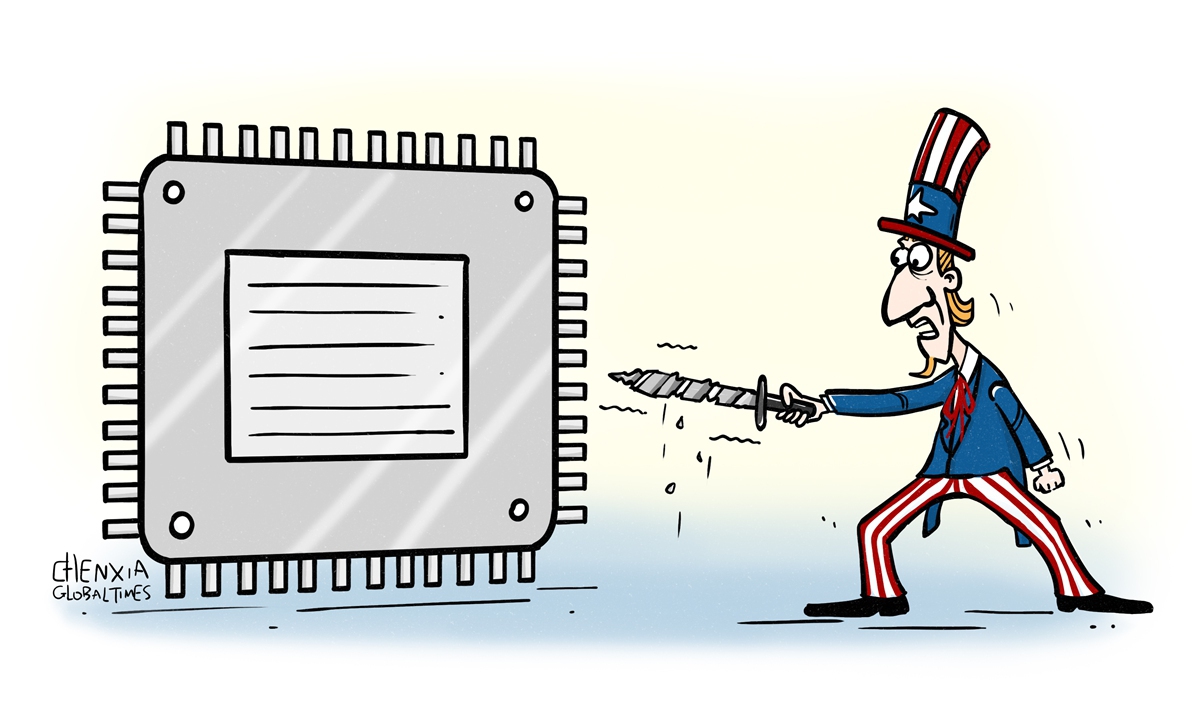

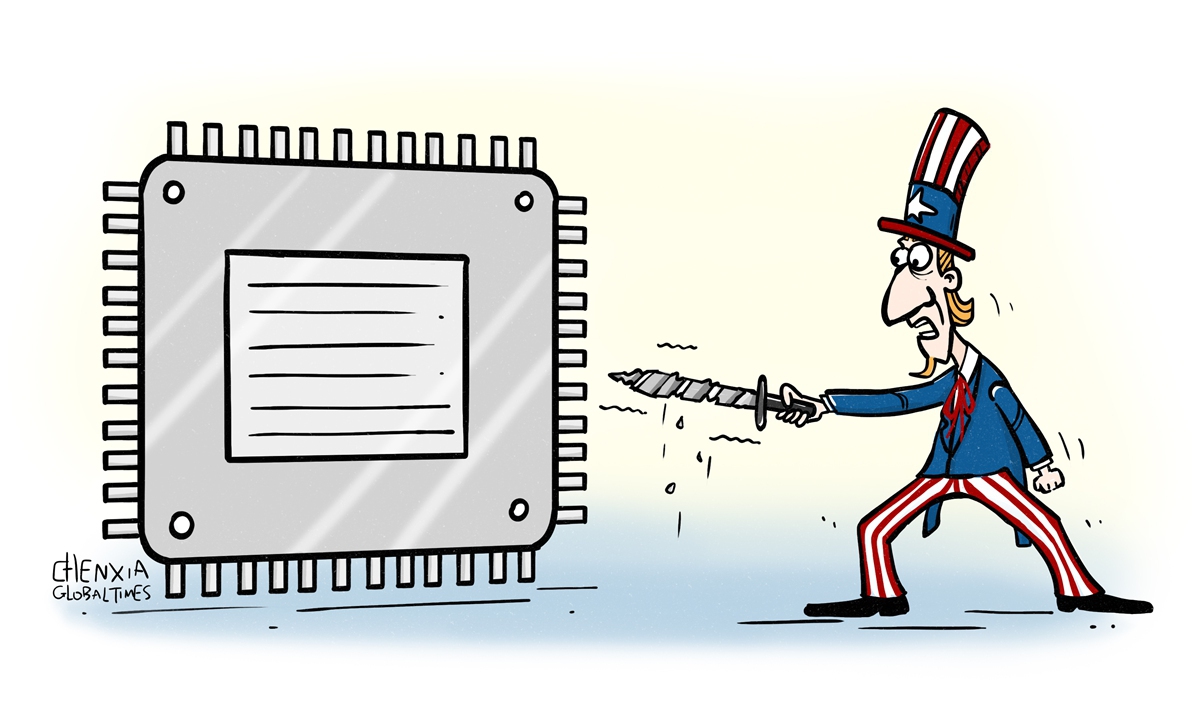

Illustration: Chen Xia/GT

The

mk US is reportedly contemplating broadening its chip export restrictions beyond China to encompass additional nations. According to sources familiar with the matter, the Wall Street Journal (WSJ) reported on Friday that the US is preparing new rules aimed at restricting the sale of advanced artificial intelligence (AI) chips in certain parts of the world, with the goal of limiting China's ability to access them. If these measures are implemented, they are expected to further disrupt global chip manufacturers and supply chains, underscoring the increasingly erratic and unsustainable nature of Washington's export control policies.

In the WSJ article, it is reported that "Washington plans rules limiting semiconductor shipments to some countries accused of supplying Beijing." However, as both a major producer and consumer in the global semiconductor supply chain, China engages in normal, mutually beneficial trade with other nations, reflecting the interconnected and interdependent nature of the global supply chain.

The framing of some countries as a "backdoor" for China's access to advanced chips - especially in the absence of concrete evidence - is not only misleading, but also unjust. Such narratives oversimplify the complex dynamics of global semiconductor trade cooperation and risk undermining the deeper realities of international cooperation and mutual dependence within the global semiconductor industry. Discussions on this issue should move beyond geopolitical rhetoric and recognize the intricate, collaborative nature of the global technology ecosystem.

The global AI chip market is currently experiencing an unprecedented surge. According to Gartner's forecast, revenues from AI semiconductors worldwide are expected to reach $71 billion in 2024, marking an impressive 33 percent increase over 2023. This rapid growth has naturally drawn the attention of numerous tech giants, all eager to claim their share of the lucrative opportunities driven by AI's exponential expansion.

While Nvidia continues to dominate the AI chip landscape, competition is swiftly intensifying. A recent report by the New York Times focuses on the rise of companies such as Amazon, Advanced Micro Devices, and several startups, which have begun to "offer credible alternatives to Nvidia's chips, especially for a phase of AI development known as inferencing."

No chip manufacturer would willingly accept restrictions that prevent their products from being sold in key markets. As Washington moves to limit China's access to advanced AI chips, it risks undermining the financial interests of American companies, many of which rely on global markets, including China, to fuel their growth. In the high-stakes world of international competition, voluntarily sacrificing profit opportunities is a perilous move, one that could erode a company's competitive advantage. If the US tightens its chip restrictions further - and expand them to include more countries beyond China - the economic ramifications for chip manufacturers, particularly American companies bound by Washington's policies, will be significant. The stricter the restrictions imposed by Washington, the greater the potential losses for the US chip industry.

Despite media reports suggesting that the US may be considering expanding its AI chip restrictions beyond China in order to prevent it from importing advanced chips from third countries, such measures won't suffocate the development of China's AI and semiconductor industries. On the contrary, such actions are more likely to accelerate China's drive for self-reliance and technological innovation. Far from stifling progress, these restrictions could fuel greater efforts within China to develop indigenous technologies.

The WSJ's report on the potential expansion of US restrictions only underscores the counterproductive effects of previous measures imposed by Washington. Rather than stalling the growth of China's AI and semiconductor industries, these restrictions appear to have unintentionally accelerated their development. The more the US tightens its grip, the more China intensifies its efforts to reduce dependency on foreign technologies. If Washington persists along this counter-productive path, extending its restrictions to more regions beyond China, it will only expose a deeper strategic impasse. Such actions would suggest that Washington has exhausted its ability to come up with more effective solutions and is resorting to more desperate, even hysterical, measures to continue its failed policies. This approach risks undermining the economic interests of American businesses and entire industries, as more and more companies are forced to pay the price for policies that have proven ineffective.