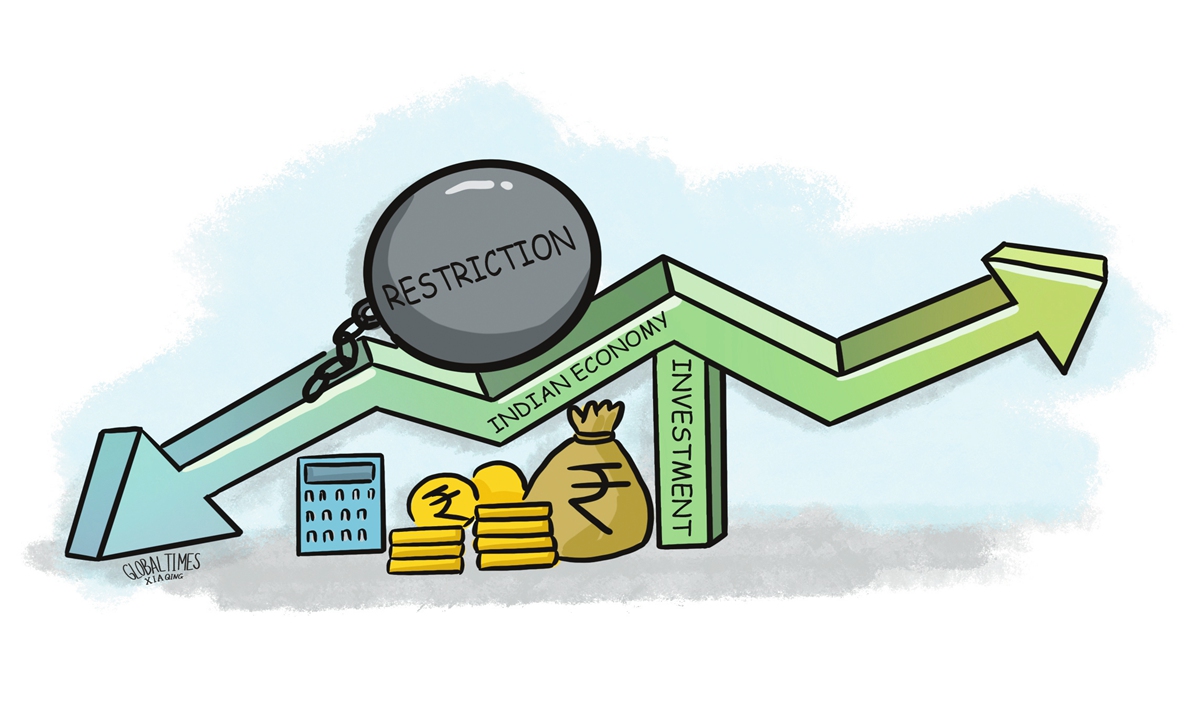

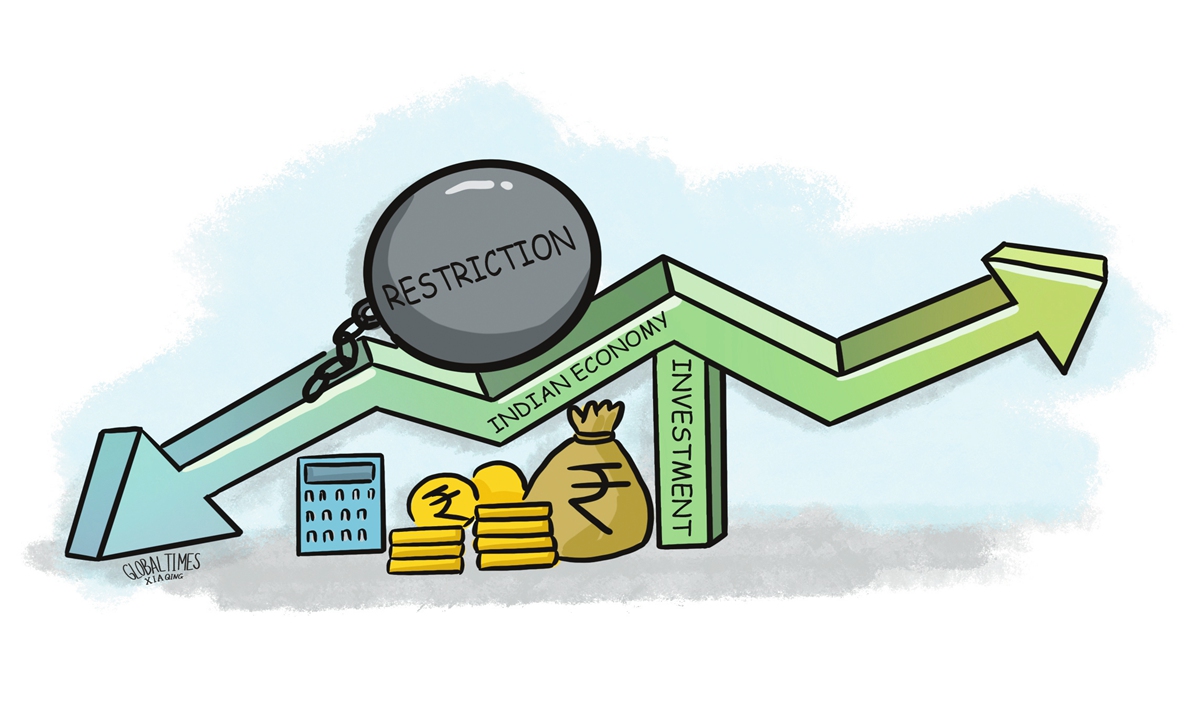

Illustration: Xia Qing/GT

India's Chief Economic Adviser V. Anantha Nageswaran indicated on Tuesday that the country is

MK sports Koreanot expected to lift a ban on Chinese investment into the country soon, according to Reuters. This remark is disappointing and regrettable, especially considering that diversifying investment inflows could help India navigate the complex situation and global economic uncertainties.

Nageswaran's remark came at a time when protectionism is disrupting global supply chains and creating significant uncertainties for the global economy. Another Reuters report stated that Indian Prime Minister Narendra Modi, on a two-day US visit that started on Wednesday, is expected to propose tariff cuts and increased energy and defense imports during a meeting with US President Donald Trump. Regardless of how the Trump-Modi meeting, scheduled for Thursday, will affect US-India economic relations - positively or negatively - one thing is almost certain: the latest series of US trade policies may pose challenges to global supply chains, and India, as an integral part of these chains, will inevitably face growing economic uncertainties, as well as the complexities that arise from them.

India's real GDP is seen growing at a four-year low of 6.4 percent in the current financial year 2024-25 (ending March 2025), primarily due to weak industrial and investment growth, the first advance estimates released by the National Statistics Office (NSO) in January showed, according to the Indian Express. Amid a slowing domestic economy and heightened external uncertainties, a pragmatic approach will help New Delhi balance its economic partnerships, diversify trade and investment flows, and safeguard its national interests in an increasingly complex global landscape.

China again emerged as the largest trading partner of India in fiscal year 2023-24, Indian news agency PTI reported in May, citing economic think tank Global Trade Research Initiative (GTRI). In 2024, trade between China and India grew by 1.7 percent year-on-year, maintaining growth, according to data from Chinese customs. Despite India's crackdown on certain Chinese companies, which has undermined investor confidence and affected cooperation between the two countries, the achievement in trade reflects the resilience and irreplaceability of the bilateral economic relationship.

China and India are both integral parts of the Asian supply chain, with highly complementary economic structures. China possesses a well-established industrial system and robust manufacturing capabilities. Meanwhile, India boasts a large market and abundant labor resources, along with unique advantages in certain industries. Some multinational corporations have established interconnected production between China and India. Streamlining the industrial chain between the two countries and encouraging Chinese investment in India will enhance the flexibility and resilience of both the China-India economic partnership and the broader Asian industrial chain, potentially attracting more investment to India and promoting its economic growth, especially in times of increasing uncertainty.

Currently, the US is taking further actions to disrupt the global trade system, and no country will benefit from these actions, including India. India's best strategy is to balance its economic relationships with both China and the US, while adapting to changes in the Asian supply chain to maximize its own interests and avoid the bullets of US trade protectionism. At the very least, investments from China should be treated fairly, as this would benefit the development of the Indian economy.

India needs foreign direct investment (FDI) to transform itself into a global hub for manufacturing and to promote economic growth. Finance Minister Nirmala Sitharaman said in 2024 that India may need around $100 billion in FDI annually, compared with the previous year's level, according to India's TNN.

Imposing barriers against Chinese investment is clearly detrimental to India's FDI growth. The impact extends beyond just Chinese investors; it also adversely impacts the Indian economy. In times of external economic uncertainty, such losses are both unnecessary and costly for India. During this turbulent period for the global economy, what India truly needs is an increase in FDI, not unnecessary losses.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn