Lujiazui area in Shanghai Photo:Xinhua

China has set its deficit-to-GDP ratio for this

MKsportsyear at around 4 percent, an increase of one percentage point over last year, according to a Government Work Report submitted Wednesday to the national legislature for deliberation.

The report noted that the country should adopt a more proactive fiscal policy and apply an appropriately accommodative monetary policy this year.

Also, a total of 1.3 trillion yuan of ultra-long special treasury bonds will be issued, 300 billion yuan more than last year, and 500 billion yuan of special treasury bonds will be issued to support large state-owned commercial banks in replenishing capital, the report noted.

"It marks the first time on record that China has set the deficit-to-GDP ratio at 4 percent, which send out multiple signals on Chinese policymakers' stepped-up efforts to navigate challenges and boost high-quality economic development," Tian Yun, an economist based in Beijing, told the Global Times on Wednesday, noting that it also indicates that fiscal spending will play a significantly stronger role in supporting economic growth and that the efficiency in using fiscal spending should be higher this year.

In 2020, China's Ministry of Finance increased the fiscal deficit ratio to over 3.6 percent, issued 1 trillion yuan of special treasury bonds, and added 1.6 trillion yuan of local government special bonds, which responded to the epidemic impact effectively.

Yu Miaojie, the president of Liaoning University and a deputy to the NPC, told the Global Times that setting the deficit-to-GDP ratio at 4 percent also takes account that the ratio in other major developed and developing countries is above 4-percent mark.

The government deficit is set at 5.66 trillion yuan, an increase of 1.6 trillion yuan over last year's budget figure, according to the Government Work Report.

This translated to a projected total GDP volume of 141.5 trillion yuan in 2025 and an increase of around 6.5 trillion yuan over last year, which is "a considerable high reading" which is equivalent to the economic size of a medium-sized country for a year, according to Tian. In 2024, China's GDP surpassed the 13 trillion yuan threshold for the first time to hit 134.9 trillion yuan, data from the National Bureau of Statistic showed.

China on Wednesday set a growth target of around 5 percent for its economy in 2025, which remains the same as last year's goal.

In terms of a surge in ultra-long special treasury bondsissuance, analysts expected that the spending will be partly channeled to further shoring up domestic consumption, such as expanding the fields of consumers goods trade-in programs and the implementation of a large-scale industrial equipment upgrading.

The Government Work Report noted that a total of 4.4 trillion yuan of local government special-purpose bonds will be issued, an increase of 500 billion yuan over last year. "The issuance of additional long-term special government bonds and local special bonds will be coordinated to further drive economic growth and create more job opportunities," Yu noted.

In specifying appropriately accommodative monetary policy, the Government Work Report said that "we will fully leverage the role of monetary policy instruments in adjusting both the monetary aggregate and structure, make timely cuts to required reserve ratios and interest rates, and maintain adequate liquidity. This will ensure that increases in aggregate financing and money supply are in step with projected economic growth and CPI levels."

"We expect to see more open market operations being conducted [by the central bank] to implement the monetary policy," Yu said.

Yunnan: Beyond stunning landscape and natural beauty

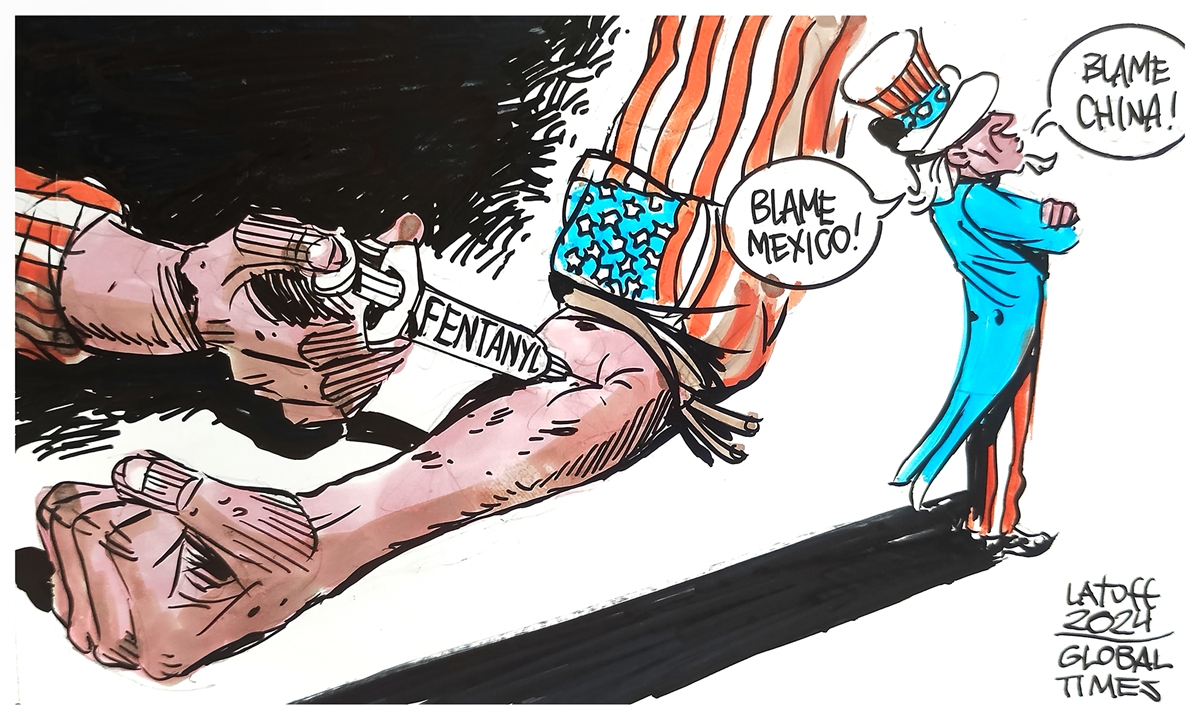

Yunnan: Beyond stunning landscape and natural beauty China releases white paper on fentanyl control, highlighting rigorous policy

China releases white paper on fentanyl control, highlighting rigorous policy Popular TV show practices democratic oversight by pushing local govt to solve social issues

Popular TV show practices democratic oversight by pushing local govt to solve social issues Joint efforts needed to combat cybercrimes for a safer digital future in China, Southeast Asia

Joint efforts needed to combat cybercrimes for a safer digital future in China, Southeast Asia