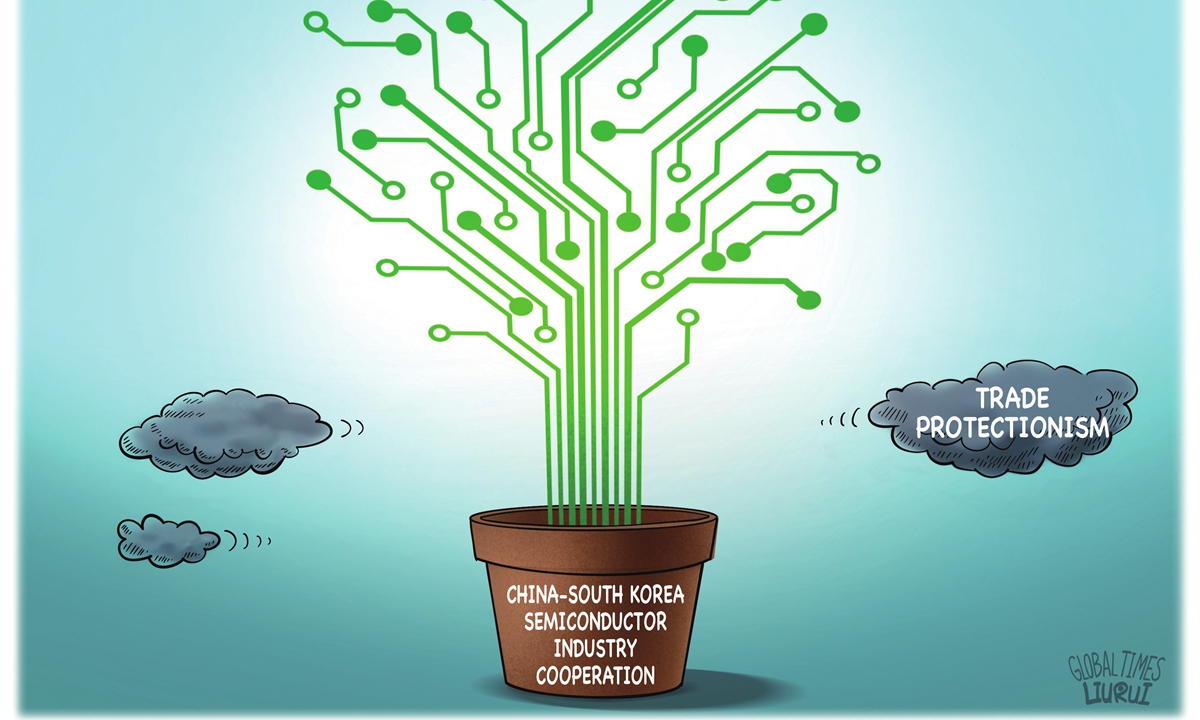

Illustration: Liu Rui/GT

Capitalizing on China's trade-in program,

MK sports Samsung Electronics and SK Hynix witnessed a boost in their sales in China last year, according to the Yonhap News Agency. This increase was not just a reflection of the resilience and profitability of the Chinese market despite Washington's stringent measures against China's burgeoning semiconductor sector - it also illuminates the potential for deeper collaboration between these two Asian countries.

Samsung Electronics saw its exports to China soar to 64.9 trillion won ($44.8 billion) last year, a 53.9 percent increase from the previous year. Samsung China Semiconductor Co, its Xi'an-based NAND flash memory manufacturing unit, reported sales of 11.2 trillion won in 2024, up from 8.7 trillion won in the previous year, according to Yonhap.

These achievements come at a time when the US has been implementing unilateral measures aimed at undermining the development of China's semiconductor industry and hindering China's access to high-tech chips and chipmaking equipment. However, the sales figures highlight the enduring capacity of the Chinese market to offer substantial benefits to global semiconductor enterprises. The figures also underscore the market as one that merits investment and continuous cultivation.

According to Yonhap, the sales growth of Samsung Electronics and SK Hynix in China was linked to the country's trade-in policies. Its report said that the Chinese government has unveiled economic stimulus measures, which have boosted demand for mobile devices and semiconductors.

An action plan released by China's State Council in March 2024 said that China aims to increase its investment in industrial and other types of equipment by at least 25 percent by 2027, compared with 2023. The plan specifies 20 key tasks in five sectors including equipment renewal and consumer goods trade-in programs, the Xinhua News Agency reported. The trade-in program, along with other policy measures, collectively fuels consumer momentum in China, further amplifying demand for a range of products, including semiconductors.

In 2024, China's semiconductor market is estimated to have experienced the world's fastest growth, with a year-on-year increase of 20.1 percent, per a December report by Yicai, which referenced data from the World Integrated Circuit Association. The ongoing expansion of China's semiconductor market has presented lucrative opportunities for global chip manufacturers.

Certainly, competition in this market is fierce, not only from foreign chip manufacturers but also from increasingly competitive Chinese companies. A key strategy to win in this market and achieve profitability is continuous technological advancement. According to a February report by Business Korea, Samsung Electronics is moving to upgrade its Xi'an plant in China to a 286-layer (V9) NAND flash process to fend off growing competition from Chinese semiconductor companies.

The sales growth of Samsung Electronics and SK Hynix in China can be a window from which to observe the China-South Korea trade dynamics. An undeniable fact is that China's consumer market is delivering dividends to South Korean enterprises.

If South Korean companies accelerate technological upgrades, these dividends can be transformed into tangible profits. Overall, in 2024, China's imports from South Korea grew by 12.4 percent. This growth highlights the potential of the Chinese market and bilateral trade.

The rise of protectionism in the US is expected to harm South Korea's exports to the US. Therefore, South Korea needs to seek new opportunities in the global market. Against this backdrop, the dividends from the Chinese market and the resilience of China-South Korea trade take on even greater significance.

The performance of Samsung Electronics and SK Hynix in the Chinese market in 2024 has bolstered confidence in deepening cooperation against the backdrop of rising international trade protectionism, showcasing the potential of the Chinese market.

In January and February 2025, China's imports from South Korea slightly decreased by 0.1 percent. Although it remains uncertain whether this is just a short-term fluctuation, it underscores the need for South Korean companies to redouble their efforts to solidify their market presence in China and aim for outcomes comparable to the previous year's successes.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn