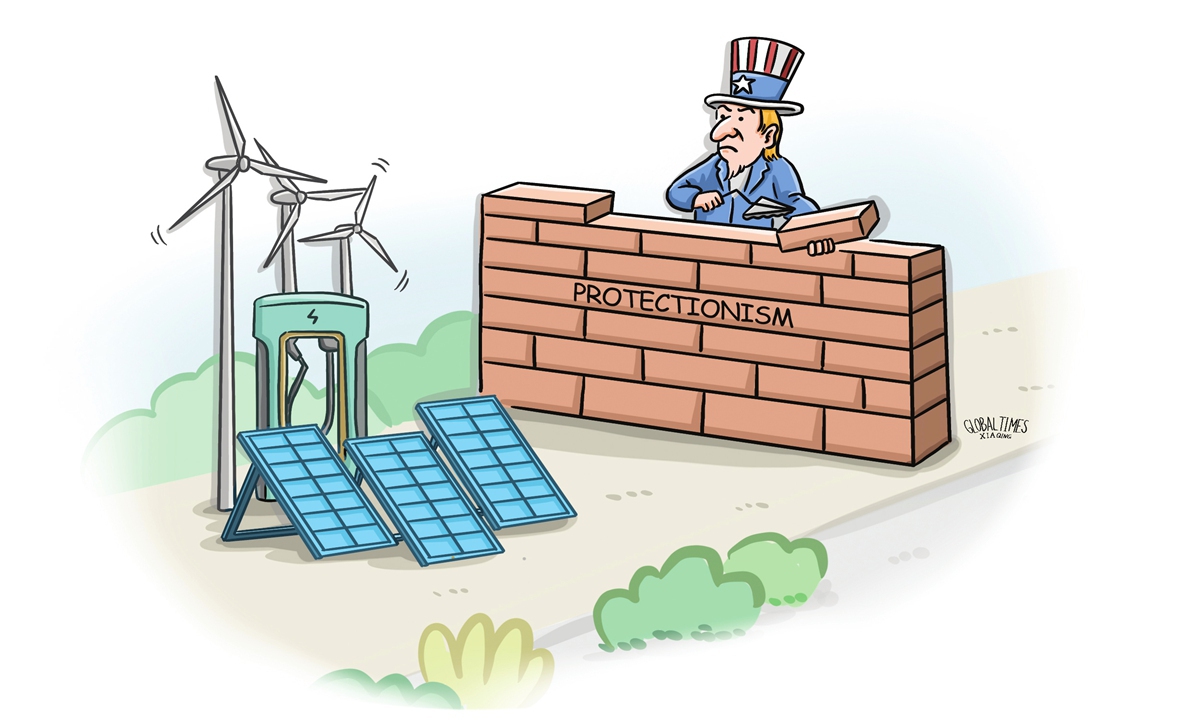

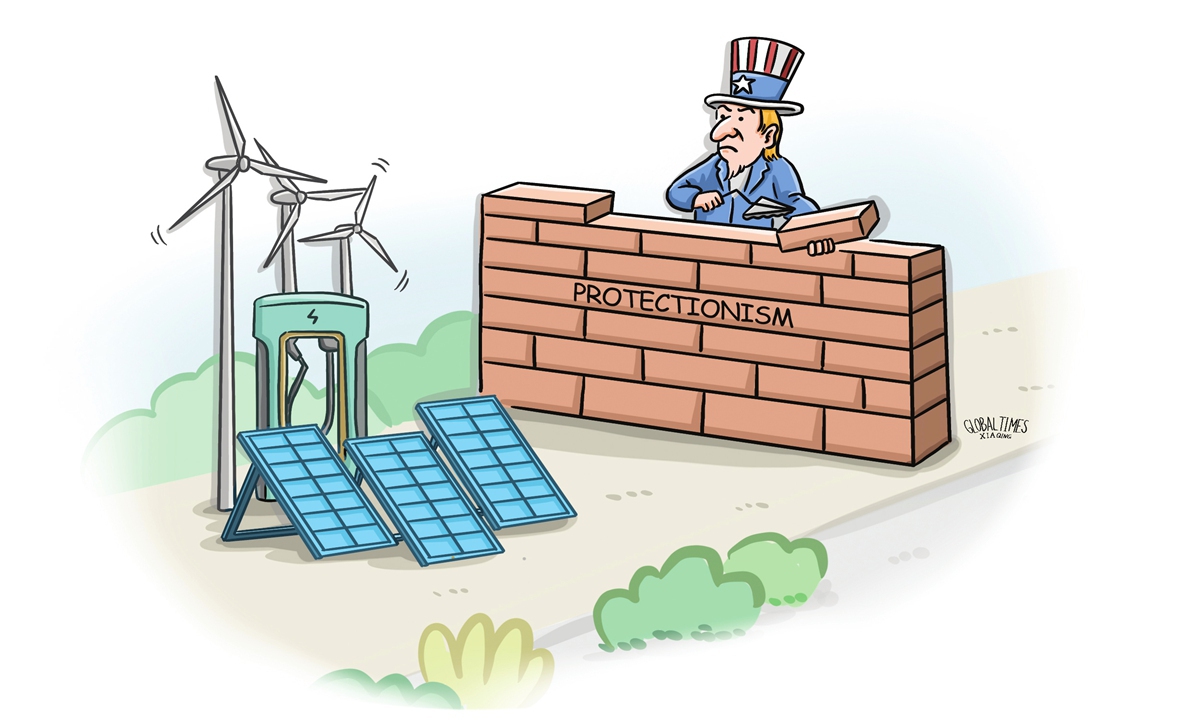

Illustration: Xia Qing/GT

US trade officials announced on Friday a preliminary decision to set a new round of tariffs on solar panel imports from four Southeast Asian nations,

MK sports Korea with calculated dumping duties of between 21.31 and 271.2 percent, depending on the company, on solar cells from Cambodia, Malaysia, Thailand and Vietnam, Reuters reported.

If these preliminary rates are upheld in the final determinations and enforced, they could further disrupt global supply chains and have a detrimental effect on the industry in countries, including the US.

According to media reports, the US photovoltaic industry, which has flourished over the past decade due to favorable subsidy policies, is now facing major challenges, with some companies grappling with financial difficulties.

For instance, Lumio, a privately owned provider of residential solar panels, filed bankruptcy with a plan to sell its business to its primary lender, Bloomberg reported in September. The Utah-based company is not the only solar industry player to file for bankruptcy this year.

Zhang Sen, secretary-general of the solar and PV products branch at the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, told the Global Times in an interview earlier this year that the closed-market ecology in the US has driven up prices in the country's photovoltaic sector. As a result, installation costs are now three to four times higher than in other nations. This price surge has led to a decline in demand for photovoltaic systems and caused numerous businesses to go bankrupt. Consequently, the growth and large-scale adoption of photovoltaic technology - and even the broader renewable energy sector - have been severely hampered in the US.

If the US imposes high "dumping tariffs" on crystalline photovoltaic cells imported from four Southeast Asian countries, it is likely to further push up the prices of domestic photovoltaic products, thereby suppressing market demand. In the end, those advocating for trade protectionism may come to realize that tariff barriers will ultimately stifle the long-term growth potential of the US photovoltaic industry.

In the global effort to combat climate change, countries around the world have been actively advancing the development of the photovoltaic industry. In recent years, Southeast Asia has experienced rapid growth in this sector, establishing itself as an important player in the global photovoltaic supply chain.

Southeast Asian countries, situated in tropical and subtropical regions, enjoy abundant sunlight, providing them with a natural edge in developing photovoltaic power generation projects. In recent years, these nations have actively promoted the growth of the photovoltaic industry, leading to a surge in investment opportunities - accessible not only to domestic players but also to foreign investors, including companies from China and beyond. Over the past decade, some Chinese firms have invested in Southeast Asia's photovoltaic sector, a trend that highlights the region's growing importance in the global clean energy landscape.

These investments, coupled with the mutually-beneficial partnerships they foster, are not only driving the expansion of the photovoltaic industry in Southeast Asia but are also playing an important role in advancing the global transition to renewable energy.

If the US imposes high "dumping tariffs" on four Southeast Asian countries, this trade protectionist move could put pressure on their photovoltaic industry chains. However, in the short term, it is unlikely to significantly undermine the region's production networks, particularly the technological and cost advantages of the companies involved. Citing Liu Yiyang, deputy secretary general of the China Photovoltaic Industry Association, Jiemian News reported in April that the US market contributes around 40 gigawatts of new installations annually, which accounts for less than 10 percent of the global market. This indicates that the impact of the US market on the broader industry remains relatively limited.

Of course, this does not mean that people should underestimate the challenges that potential US trade protectionist measures could pose to international supply chains. For photovoltaic companies in the four Southeast Asian nations, as well as international investors - including Chinese firms - there is a pressing need to boost technological innovation, accelerate industrial upgrading, diversify markets, and strengthen supply chain resilience. By focusing on these areas, companies can better protect their competitive advantage in an increasingly volatile global market.