Illustration: Xia Qing/GT

A report from the Nikkei on Tuesday revealed that global investment in equipment by the top 10 semiconductor companies totaled $123.3 billion in 2024,

MK sport a 2 percent decline from the previous year and a downward revision of about $9.5 billion from earlier plans. This reduction may have been influenced by various factors, so it might be premature to conclude that leading semiconductor firms are adopting a more cautious market outlook or scaling back production capacity, solely based on this adjustment. Nevertheless, this trend warrants careful observation, as it could offer valuable insights into the evolving dynamics of the industry.

Some studies indicate that the global chip market is booming, but there are signs of a slowdown. In September 2024, research firm Gartner estimated an 18.8 percent rise in global semiconductor revenue for 2024, but this growth rate is expected to taper to 13.8 percent in 2025. According to Gartner, this surge is primarily driven by artificial intelligence (AI) chips.

However, demand from the vehicle and industrial sectors remains weak. Constrained by slowing demand, companies in certain sub-sectors may face pressure to reduce inventory. Therefore, it would not be surprising if new investments declined.

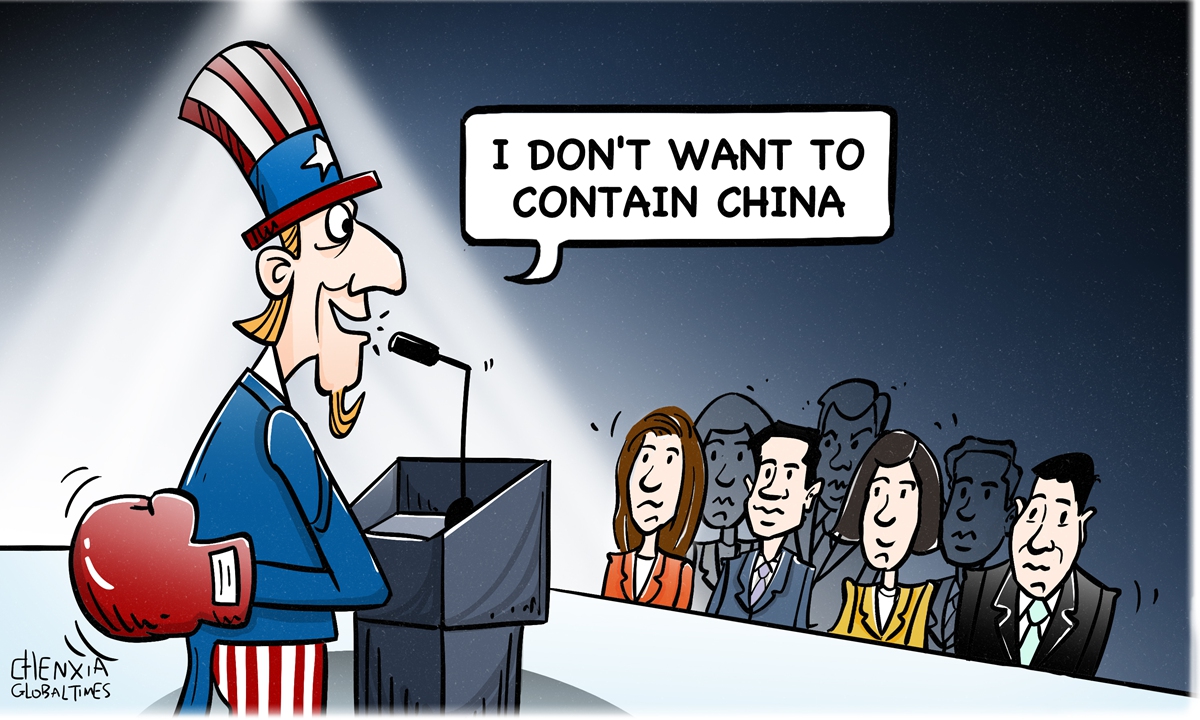

Semiconductors are a highly cyclical industry, marked by alternating periods of prosperity and recession - a pattern that is, in itself, quite natural. What is concerning, however, is the trend in the US of hyping the notion of "supply chain security," positioning chips as a strategic asset. On the one hand, the US has encouraged both domestic production and that of allied nations, spurring an expansion of chip manufacturing through subsidies and other measures. This has led to an increase in chip production driven more by political considerations than economic forces, resulting in an oversupply.

On the other hand, the US has put up barriers to suppress exports of advanced chips to China, thereby shrinking the market for Western chip companies. These actions, taken together, have artificially disrupted the global semiconductor supply chain and its natural rhythm.

In the near future, the global semiconductor market may be confronted with increasing uncertainties. Against this backdrop, if the report by the Nikkei proves accurate, this suggests that leading chip manufacturers worldwide have already begun to scale back investments in new equipment, a phenomenon that warrants attention. While the global chip market continues to grow, the landscape for non-AI semiconductors is becoming ever more complex.

Some may remember how Micron's stock plunged by as much as 17 percent, dropping to $86.13 when trading opened in New York on December 19. This marked the steepest intraday decline since March 2020. A Bloomberg report at the time stated that although Micron was seeing strong orders for components used in AI computing, it still faced lackluster demand from makers of phones and PCs - two markets that consume the majority of its chip volume.

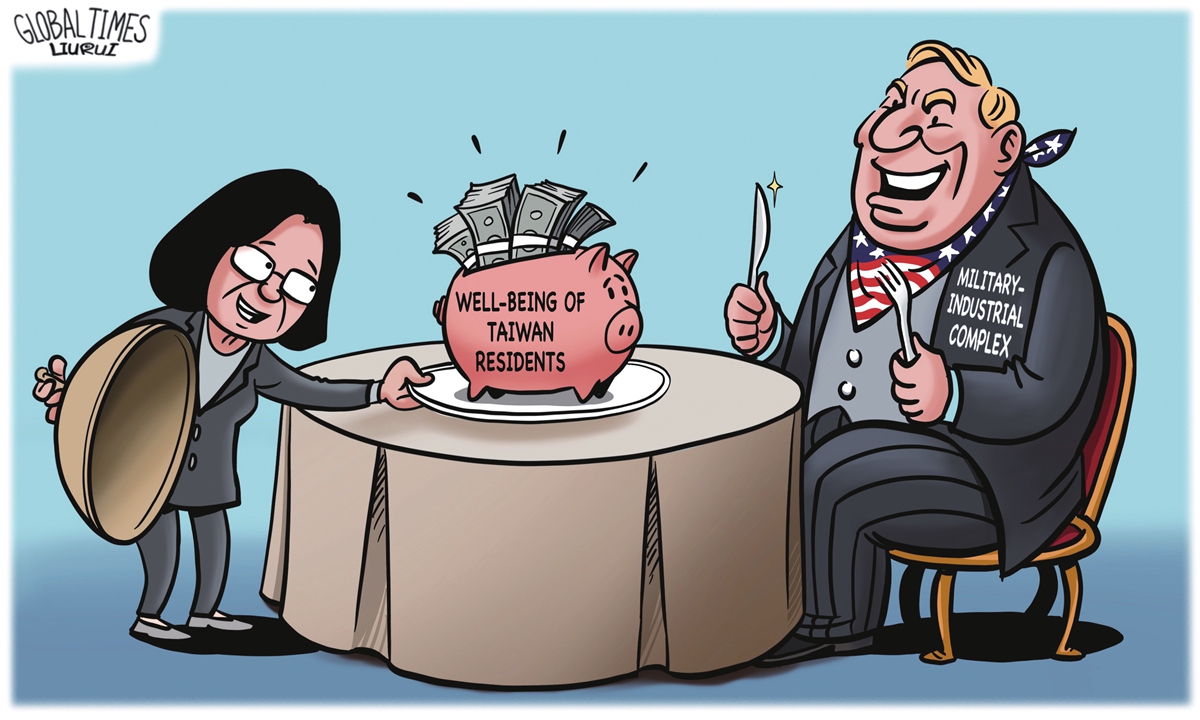

As the chip market grapples with increasing uncertainty, Washington's interference and disruption are likely to impose greater challenges on semiconductor companies. In times of such unpredictability, the need to maintain a firm grip on the market becomes even more critical. China, as the world's largest semiconductor market, holds undeniable significance for global chipmakers.

According to a report released by the World Integrated Circuit Association (WICA) in December, the scale of the Chinese mainland's integrated circuit (IC) market is estimated to have grown by 20 percent in 2024, reaching $186.5 billion - accounting for 30 percent of the global total, as reported by Yicai Global. This positioned China once again as the largest and fastest-growing IC market.

According to the WICA, the international semiconductor market declined in 2023 but is likely to have rebounded in 2024, achieving double-digit growth.

Although the global chip market is fraught with uncertainty, one truth stands clear: China plays an important role in this market rebound, serving as a key driving force. For chip companies seeking to capitalize on new market opportunities in such a volatile environment, their performance in China will be crucial. Even as the US continues to enact measures that disrupt the global supply chain, the significance of the Chinese market only grows more apparent.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn

MND: By Making Provocations, the Philippines Undermines the Common Interests of Regional Countries

MND: By Making Provocations, the Philippines Undermines the Common Interests of Regional Countries Manila urged to stop abusing arbitration, disrupting South China Sea

Manila urged to stop abusing arbitration, disrupting South China Sea RIMPAC, a 'muscle show' exposing US' true face as a 'paper tiger'

RIMPAC, a 'muscle show' exposing US' true face as a 'paper tiger' Euro 2024 news: England and Spain squads return home after final – as it happened

Euro 2024 news: England and Spain squads return home after final – as it happened