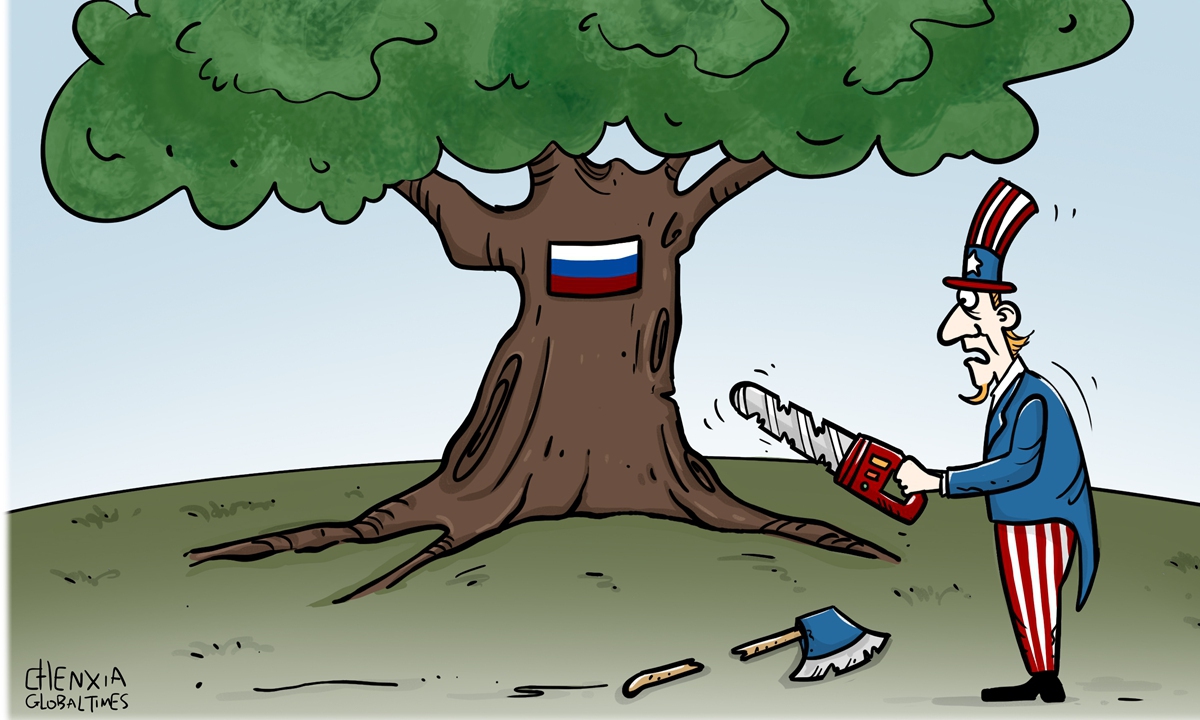

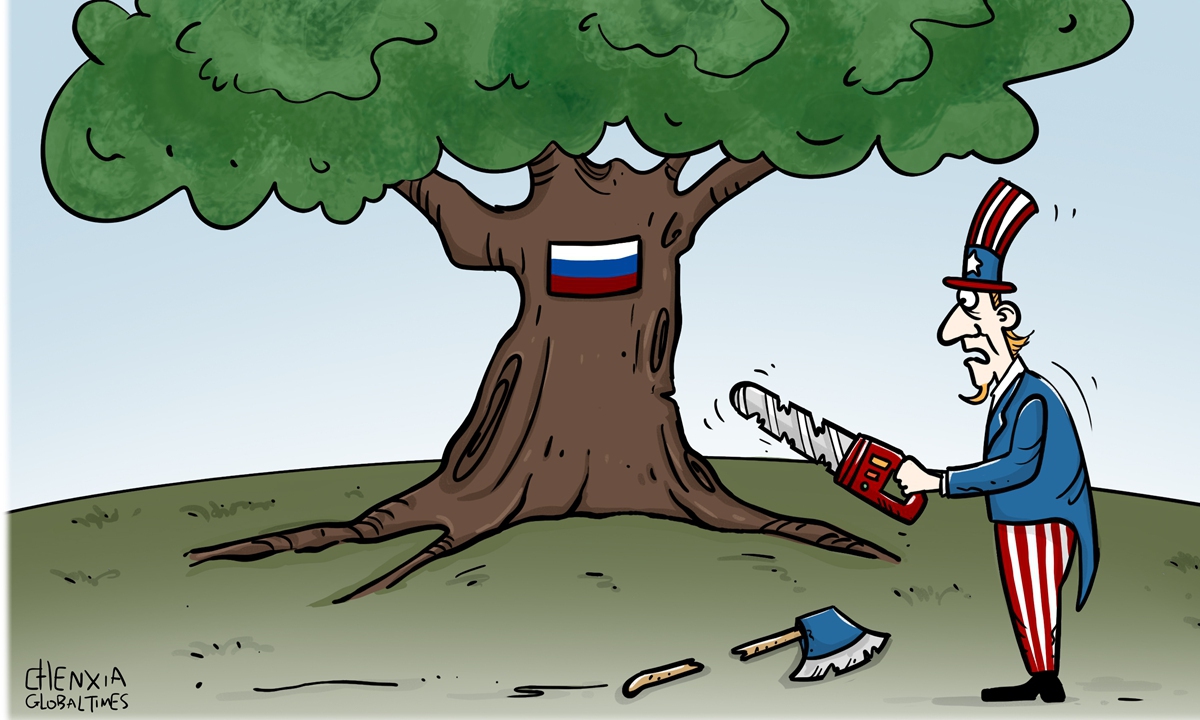

Illustration: Chen Xia/GT

Recently,

MK sport the US and the EU have been considering confiscating Russian assets worth hundreds of billions of dollars. While this move is aimed at supporting Ukraine, it has broader implications for international law and financial stability.

At the beginning of the Russia-Ukraine conflict, the US and its allies immediately froze $300 billion worth of Russian overseas assets, most of which is in the EU nations, with about $5 billion in the US. As the war continues, these funds have not been used.

The frozen assets are immobilized and can't be accessed by Moscow - but they still belong to Russia.

While governments can generally freeze property without difficulty, turning that property into forfeited assets that can be sold for the benefit of Ukraine requires an extra layer of judicial procedure, including adjudication in a court.

For over a year, the US and European countries have been debating the legitimacy of confiscating the Russian assets and giving them to Ukraine.

The US has recently taken legislative steps to authorize the confiscation of approximately $300 billion in frozen Russian reserves through the Rebuilding Economic Prosperity and Opportunity for Ukrainians Act. This bill clearly demonstrates the intention of the US to support Ukraine using frozen Russian assets.

Meanwhile, the EU is also considering similar measures, with the goal of obtaining 15-20 billion euros ($16-21 billion) from Russian assets by 2027. These legislative efforts have raised significant concerns about the legal and moral boundaries of a country taking action against foreign assets.

If Russia chooses to retaliate against asset seizures, it could lead to a significant escalation of conflict and even trigger a large-scale financial war. While Russia may not have the same economic leverage as Western countries, any retaliatory measures could have serious global economic consequences.

The long-term effects of such confiscations could be far-reaching, leading to increased geopolitical risks and a reassessment of asset security and legal protection in international jurisdictions. Other countries may begin to reassess their financial risk exposures and develop new legal strategies to protect their assets from similar confiscations in the future.

Confiscation of Russian assets could be seen as a violation of the principle of state sovereignty immunity, which asserts that the assets of one state are inviolable in the territory of another.

For countries which maintain a neutral position in the Russia-Ukraine conflict, the confiscation of Russian assets raises concerns about the broader implications for international law and financial norms.

They are particularly concerned about the precedent such behavior sets for the disposal of state assets in times of conflict and how it may affect their own assets abroad.

There is a popular American and Western self-explanatory argument that the confiscation of frozen Russian assets will not affect the assets of other countries or change the incentives of governments that are not planning a large-scale war. This is tantamount to saying that those countries advocating confiscation of Russian assets will not start a war, a claim that is not only unsupportable, but is simply contrary to historical fact.

The global community must carefully consider the impact that the possible confiscation of Russian assets could have on global peace, and work toward solutions that respect the sovereignty of all states and preserve the integrity of international law.