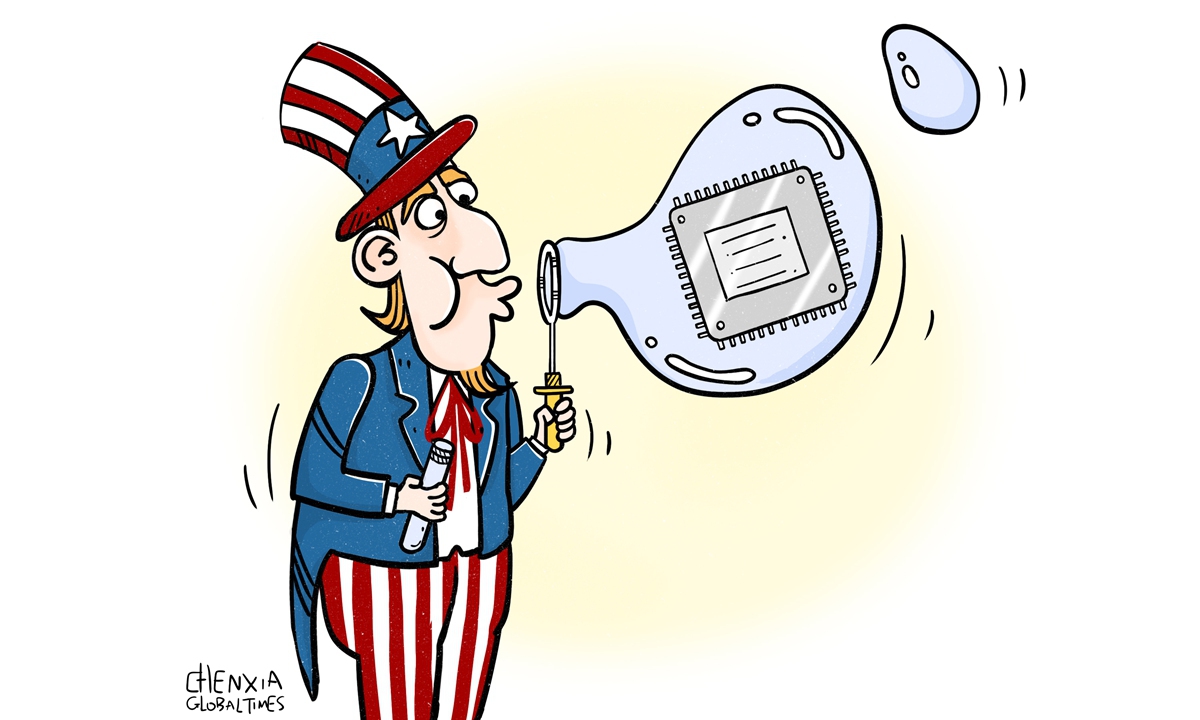

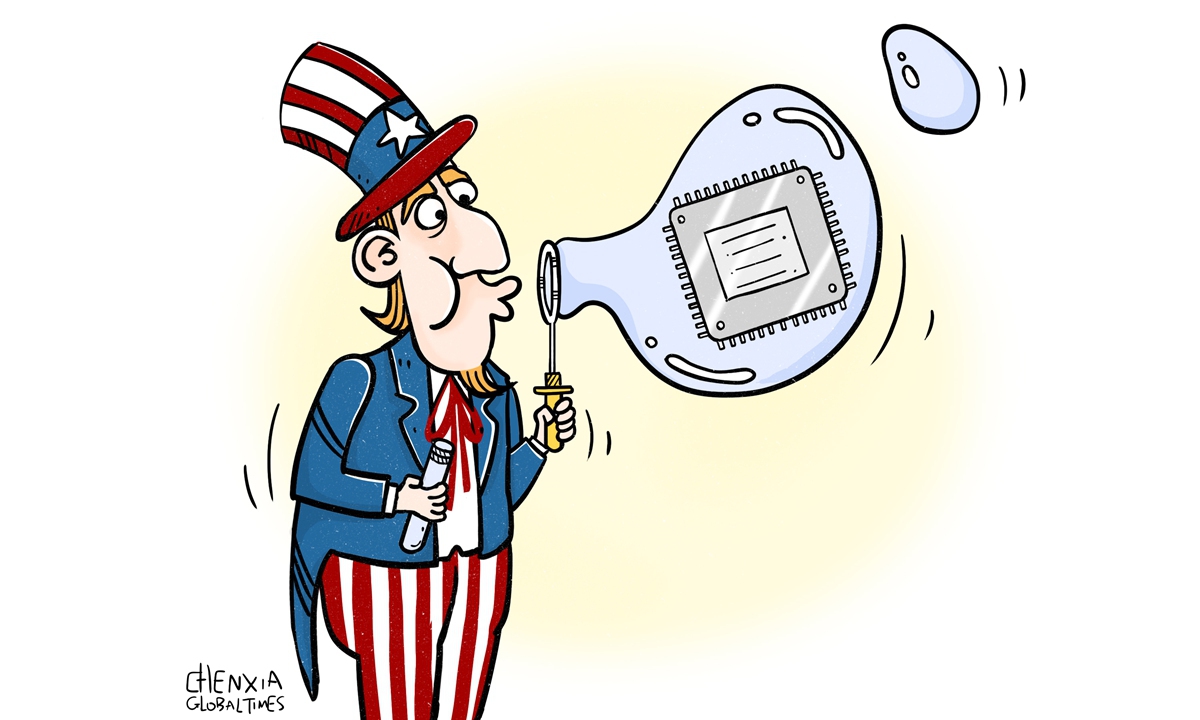

Illustration: Chen Xia/GT

While aiming to expedite the reshoring of chip manufacturing,

MKS sports the US subsidy policy has actually exacerbated bubbles in the chip industry, causing turmoil in global financial markets.

The US Commerce Department said on Tuesday that it plans to award SK Hynix up to $450 million in grants and $500 million in loans to help build an advanced chip packaging and research facility in the state of Indiana, Reuters reported.

While the funding for SK Hynix is not exactly small change, it is quite modest compared with what Intel will receive in subsidies. In March, the US Department of Commerce announced $8.5 billion in grants and $11 billion loans for Intel, which US Commerce Secretary Gina Raimondo described as "a massive step toward ensuring America's leadership in manufacturing for the 21st century," according to a report on Intel's website.

The huge disparity in subsidies underscores the unequal treatment of domestic and foreign companies under the Chips and Science Act, and it reveals the biased US policy toward the semiconductor industry. The US government has implemented a dual approach of coercing and incentivizing major global chip companies to build factories in the US in order to rejuvenate its semiconductor sector. However, the support provided to domestic companies far outweighs that given to foreign companies, indicating the real intention of plundering the technology and profits of global chipmakers and ensuring the dominant position of the US in this field, which could have far-reaching geopolitical and economic implications in the global semiconductor industry.

Moreover, the subsidies come with strict conditions, and it is unknown whether chipmakers can ultimately meet those conditions. For example, the Chips and Science Act requires chipmakers applying for subsidies to disclose key operational information including production capacity, utilization rates and sales prices, which often involve a company's business secrets.

In addition, companies receiving subsidies are not allowed to expand semiconductor manufacturing capacity in "countries of concern," including China, within 10 years.

Indeed, since the introduction of the Chips and Science Act, foreign chipmakers that have invested in the US have found that the promised subsidies are not so easy to get and are likely to fall short of their expectations, due to the high number of applicants.

The US government only approved a $39 billion subsidy program for semiconductor manufacturing and related components, but it turns out that the Commerce Department has already announced term sheets with 15 companies offering about $30 billion in funding, according to Reuters. This means the subsidies left for other manufacturers are already very limited.

The US subsidy program is essentially about its technological hegemony and it exposes protectionist tendencies toward its own chip industry. Its goal is to support domestic chipmakers while exerting control over foreign ones, concentrating the chip industry in the US.

But subsidies are unlikely to resolve the problems facing the US semiconductor industry, and may even exacerbate the formation of market bubbles, hastening their collapse. The recent downturn in the Nasdaq and the struggles faced by chip companies can be attributed in part to the government subsidies.

While the Chips and Science Act offers significant financial backing to advance the domestic semiconductor industry, thereby reducing production costs and enhancing competitiveness, it also runs the risk of creating excess capacity and triggering market bubbles.

The formation of these bubbles is also largely due to the slow adaptation of American chipmakers to manufacturing applications, which is in part due to the lack of market sensitivity caused by excessive government support.

Intel's recent struggles, including a significant workforce reduction and suspension of dividends following disappointing financial results, serve as a stark reminder that excessive government backing alone is not a guarantee of success for America's "chip dream."

What is more concerning is that its containment of others' technological development and consolidation of its own technological hegemony is creating bubbles that are on the verge of creating new chaos in the global financial markets.